Is Q4 2017 Another Inflection Point For Penumbra?

by Kenny Dolgin, Data Insights, Guidepoint

Penumbra Inc. (NYSE: PEN) is a key player in the treatment for ischemic stroke, having received FDA approval for the first aspiration-based thrombectomy system in 2007 and having since launched five new generations of the device. In the U.S., Penumbra caters to a total addressable market of approximately $1.5 billion, in which mechanical thrombectomy is only 15% penetrated today. Recently, numerous clinical trials, most notably COMPASS in January 2018, showed that using aspiration as a first-line therapy is as effective as stent retrievers, while reducing procedure time and cost. As a result, some analysts believe that Penumbra’s aspiration technology will continue to outpace the growth of the broader mechanical thrombectomy market.

However, other analysts have raised questions about the company’s future growth due to upcoming competition from Medtronic and Terumo. For example, in January 2018, the FDA approved Medtronic’s Riptide Aspiration system, which represents the first on-label competition to the Penumbra System.

With these questions about Penumbra’s future growth, how can investors monitor the continued adoption of their aspiration system, the launch of their 3D stent retriever, and the impact of upcoming competition from Medtronic and Terumo?

Guidepoint’s Qsight is the answer.

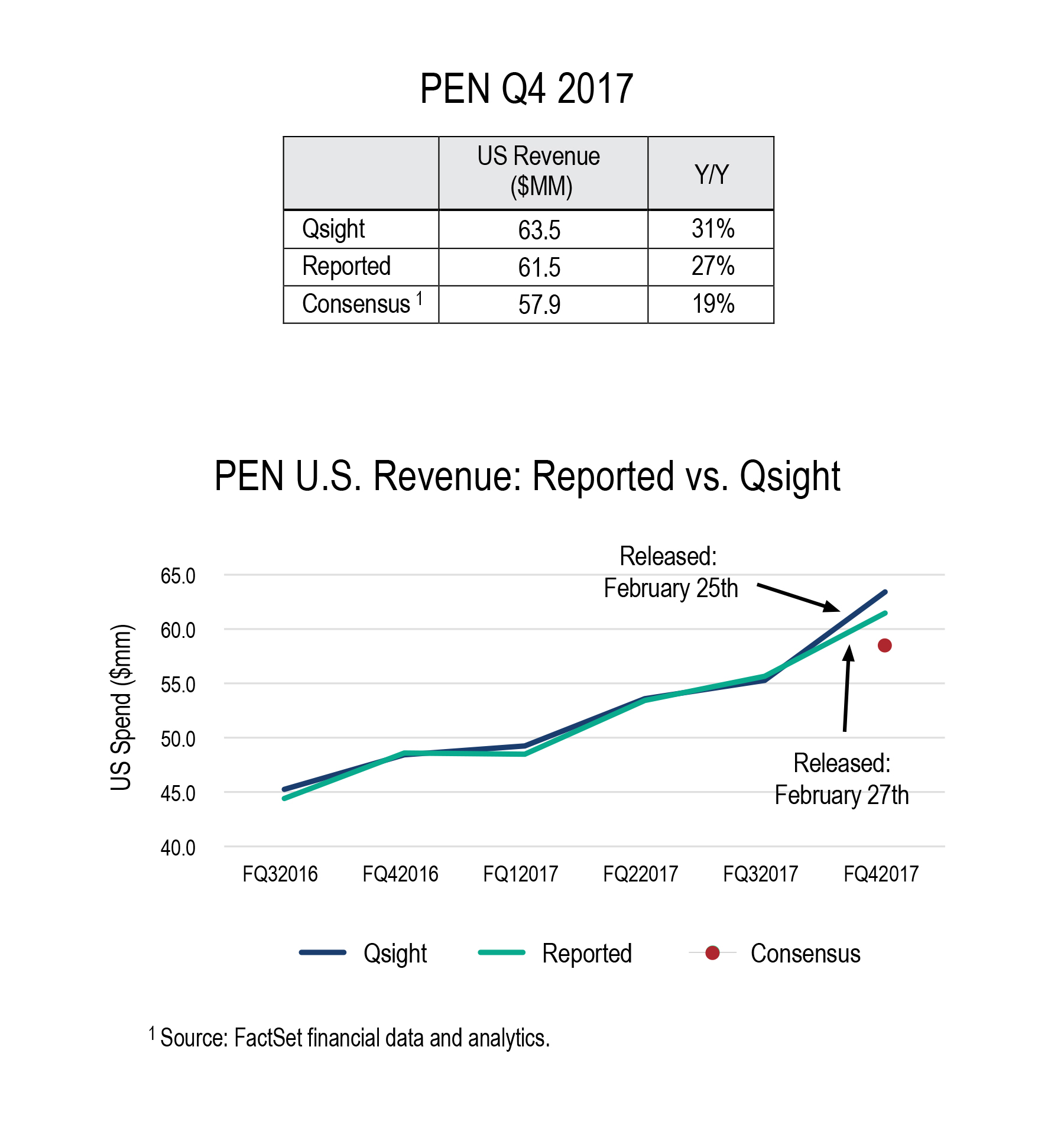

Guidepoint’s Qsight analysis of proprietary U.S. hospital purchasing data, tracks monthly purchasing of over 1,500 hospitals in near real-time. Prior to their earnings release, Qsight’s data and projection methodology indicated that Penumbra’s Q4 2017 revenues could be much higher than Street estimates. Penumbra’s Q4 2017 U.S. reported revenue outperformed Street expectations, sending the stock price soaring higher than 10% in early market trading the following day.

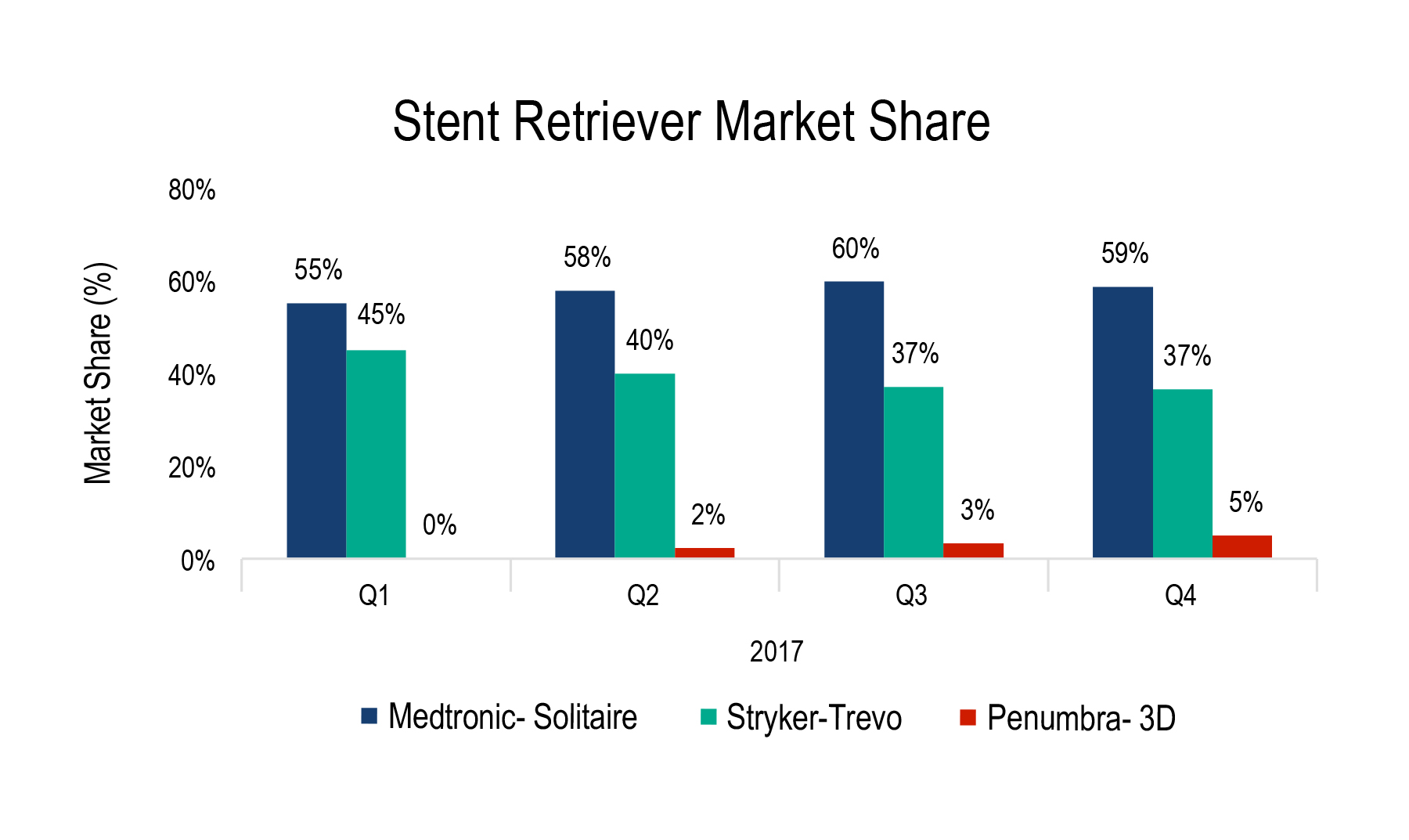

Guidepoint Qsight’s monthly data can also provide timely information on the impact of Penumbra’s new 3D launch on the U.S. stent retriever market. Qsight data indicates that since the launch of 3D in Q2 2017, Penumbra has taken ~ 5% market share and therefore, 3D should be an important revenue driver for Penumbra going forward.

As an existing or potential shareholder in Penumbra, why would you not want access to real-time market data on its key products?

About Guidepoint Qsight Healthcare

Guidepoint Qsight Healthcare provides a multi-dimensional, quantitative view that tracks company performance in the healthcare industry. By leveraging the power of proprietary industry data along with Guidepoint TRACKER’s primary data, Guidepoint can provide a level of insight into market dynamics not found anywhere else. With additional data added over time, this innovative new approach provides high-valued, coverage-driven insights for investment clients.

Guidepoint is not a registered investment adviser and cannot transact business as an investment adviser or give investment advice. The information, analyses, forecasts, metrics, samples, estimated figures, trends, charts, tables, graphs, and projections contained herein or in any Guidepoint Data Product do not represent, contain or constitute investment advice and are not intended as an offer to sell or solicitation of an offer to buy any security, or as a recommendation to buy or sell any security and should not be relied upon as the basis for any transactions in securities.